Systemize for Scale: Build a Business That Runs Without You

Discover how to systemize your business for scale. Document workflows, fix bottlenecks, and create repeatable processes that allow your business to grow without relying on you.

Podcast Spotlight: Michelle Scribner on The Unforgiving Yourself Show

Michelle Scribner shares actionable strategies to solve cash flow challenges, systemize your business, and achieve financial freedom. Listen to her insights on The Unforget Yourself Show.

Fire these clients and offerings (so you can finally grow)

Removing low-performing clients and services isn’t negative—it’s strategic. Learn how to prioritize high-value work, improve margins, and grow your business in 2026.

Define Your Unique Offering: Stand Out or Get Lost in 2026

Define your unique offering and stand out in 2026. Attract ideal clients, clarify your mission, and create a compelling professional label that differentiates your business.

Focus beats hustle: how to build a smarter growth strategy for 2026

Hustle spreads resources thin. Focus drives profit. Learn how to build a smarter growth strategy for 2026 by prioritizing top clients, removing low-value work, and systematizing what works.

Clone Your Best Clients: How to Attract More Giant Pumpkins in 2026

Business growth comes from client quality, not volume. Learn how to identify your best clients, map where they gather, and attract more profitable relationships in 2026.

Your December Action Plan: 8 tasks to close 2025 with clarity

December offers a critical opportunity for year-end financial review and strategic planning. This December business action plan outlines eight essential tasks covering Profit First allocations, client profitability, cash flow review, and business health assessment. Use this checklist to gain financial clarity, focus on top clients, and enter 2026 with a clear plan for sustainable growth.

Your Sweet Spot Check-In: Are You Operating Where You Thrive?

Many business owners spend hours on tasks that drain energy and deliver low returns. Learn how to focus on your Sweet Spot: top clients, unique offerings, and efficient systems. Use assessments and frameworks to reclaim time, increase profitability, and operate where you thrive.

The Weeds You Need to Pull: Identifying What's Draining Your Business

Many business owners chase every opportunity and serve every client, including those that drain energy and reduce profit. This guide shows how to spot the survival trap, rank offerings by profitability, prune low-value clients, and evaluate new opportunities strategically. Reclaim resources and focus on what truly drives growth.

What Your Numbers Are Really Telling You: A Profit First Review

Many business owners feel confident in revenue but uneasy about profit. This Profit First review shows how to compare Current Allocation Percentages with Target Allocation Percentages, assess client and product profitability, and track your Monthly Nut. Discover actionable steps to align revenue, expenses, and profit for stronger financial health.

Are You Growing Your Best Pumpkins? A Year End Client Review

A clear year end client review shows who drives revenue, who drains resources, and where your profit comes from. Use the Ideal Client Profiler and Top Client Assessment frameworks to rank clients, confirm profitability, and focus your 2026 plan on relationships that strengthen margin and growth.

What Fear Is Really Telling You: Turning Uncertainty Into Better Business Decisions

Many business owners feel fear when margins tighten or financial uncertainty rises, yet the right response is not avoidance. This blog explains how to use fear as information and how clear financial data supports confident decision making. Learn how business owners reduce stress by reviewing real numbers, tracking cash flow, and focusing on financial systems that replace uncertainty with clarity.

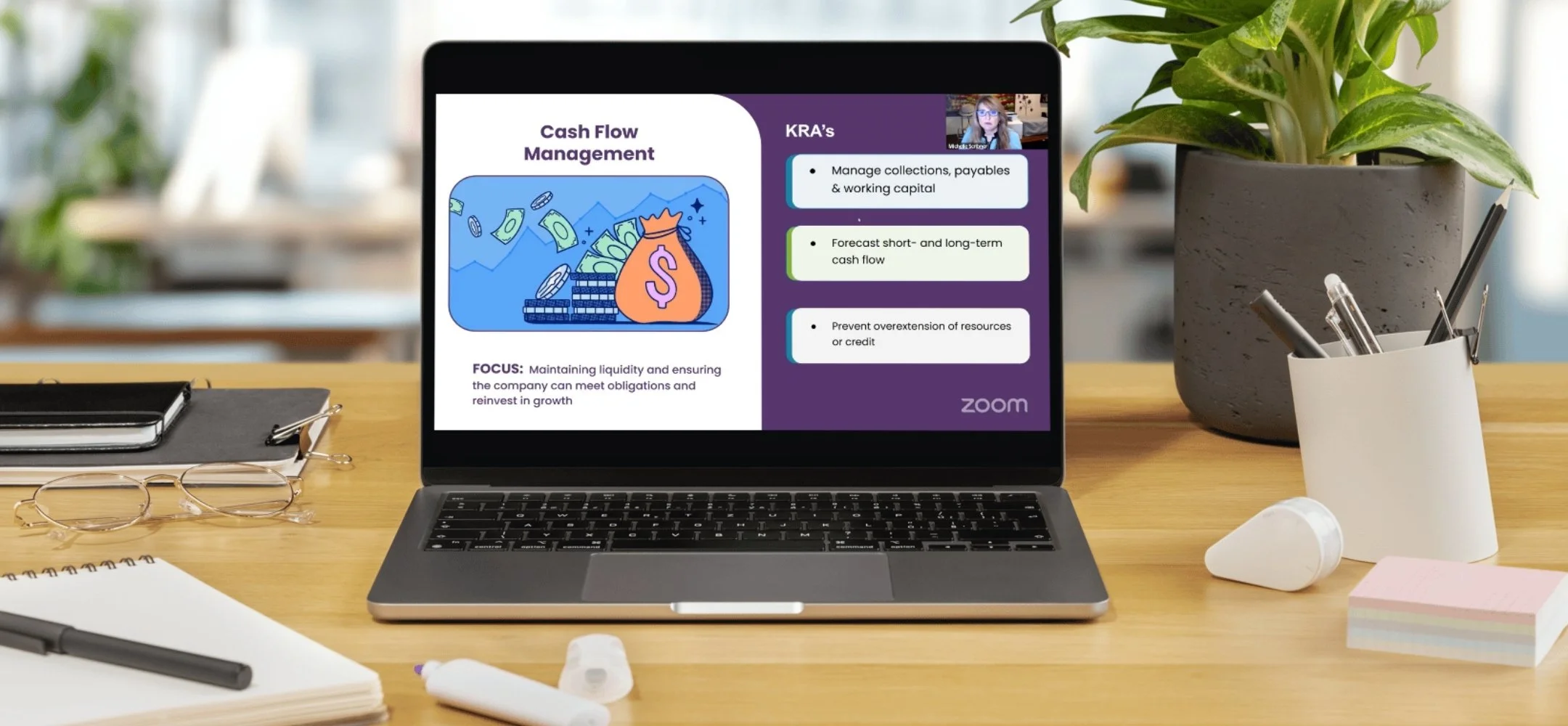

Expert Workshop: Master Your Cash Flow to Drive Sustainable Business Growth

Many businesses fail despite being profitable. Learn actionable cash flow strategies from Michelle Scribner’s workshop to keep your business solvent, stable, and growing in 2026.

When the Math Doesn't Work: Why You Shouldn't Carry It Alone

When expenses rise and margins shrink, most business owners try to fix their financial problems alone — often without realizing the hidden costs of carrying too much by themselves. In this blog, discover why partnering with a Fractional CFO or financial strategist can uncover unprofitable projects, improve cash flow, and bring clarity to your financial decisions. Learn how expert guidance helps business owners see the real story in their numbers and make confident, data-backed choices.

Sitting in the Messy Middle: Finding Clarity in Uncertain Business Finances

Business finances aren’t always straightforward, especially during seasons of growth or transition. In this blog, learn how to navigate financial uncertainty, uncover hidden cash flow issues, and find clarity even when your numbers don’t make sense. Discover how consistent bookkeeping, cash flow tracking, and Profit First financial management can help business owners move through the messy middle with confidence and focus.

Three Numbers That Tell You Everything About Business Health

Tired of drowning in endless reports? Learn how three key business metrics—cash position, pipeline velocity, and team capacity—can give you a complete snapshot of your company’s financial health in minutes. This blog explains how to use these metrics to improve cash flow, forecast growth, and make confident business decisions. Discover how a Fractional CFO helps you build systems that track the right numbers and turn data into action.

The KPI Trap: How to turn numbers into action

Many business owners track KPIs but still feel stuck when it comes to improving profitability and cash flow. In this blog, learn how to connect your Key Performance Indicators (KPIs) to Key Result Areas (KRAs) so your metrics actually drive results. Discover how a Fractional CFO uses financial analysis, forecasting, and performance systems to turn your business data into actionable strategies that boost profit and cash flow.

Expert Workshop: From Data to Decisions—The KPIs That Actually Matter

Many business owners track dozens of business metrics but struggle to identify the KPIs that support profitability, cash flow management, and strategic decisions. This blog explains how to focus on financial KPIs that reveal operational efficiency, profit health, customer acquisition cost, and long-term stability. Learn how to connect your Key Performance Indicators to results that move your business forward and help you make confident decisions.

Stop Measuring Everything and Start Managing What Matters

Many business owners track dozens of metrics but still feel unclear about performance. In this blog, discover how to simplify your financial management by focusing on 5 core business drivers—cash flow, profitability, client retention, operational efficiency, and revenue health. Learn how a Fractional CFO helps you stop drowning in spreadsheets and start making smarter, data-driven decisions for sustainable business growth.

Scaling Your CFO Practice Without Losing Your Mind

Scaling a fractional CFO practice doesn’t have to mean burnout. By focusing on your ideal client size, creating tiered pricing, and building systems with the right team, you can grow profitably and sustainably. Learn how to overcome the “Michelle Gap,” delegate effectively, and position your CFO services for long-term success.