Expert Workshop: From Data to Decisions—The KPIs That Actually Matter

Stop tracking everything and start measuring what moves your business forward.

The overwhelm of "measure all the things"

Business owners are drowning in data.

Website analytics. Social media metrics. Sales reports. Expense tracking. Revenue dashboards.

Everyone says you need to "know your numbers." But which numbers actually matter?

During our October workshop, we cut through the noise to answer one critical question: What should you actually be measuring to make better business decisions?

The difference between busy tracking and useful tracking

Here's what most business owners get wrong: they confuse activity with insight.

Tracking revenue is activity. Understanding gross profit margin is insight.

Logging hours is activity. Measuring operational efficiency is insight.

The framework starts with understanding two key terms:

Key Performance Indicators (KPIs): The specific, measurable numbers you track.

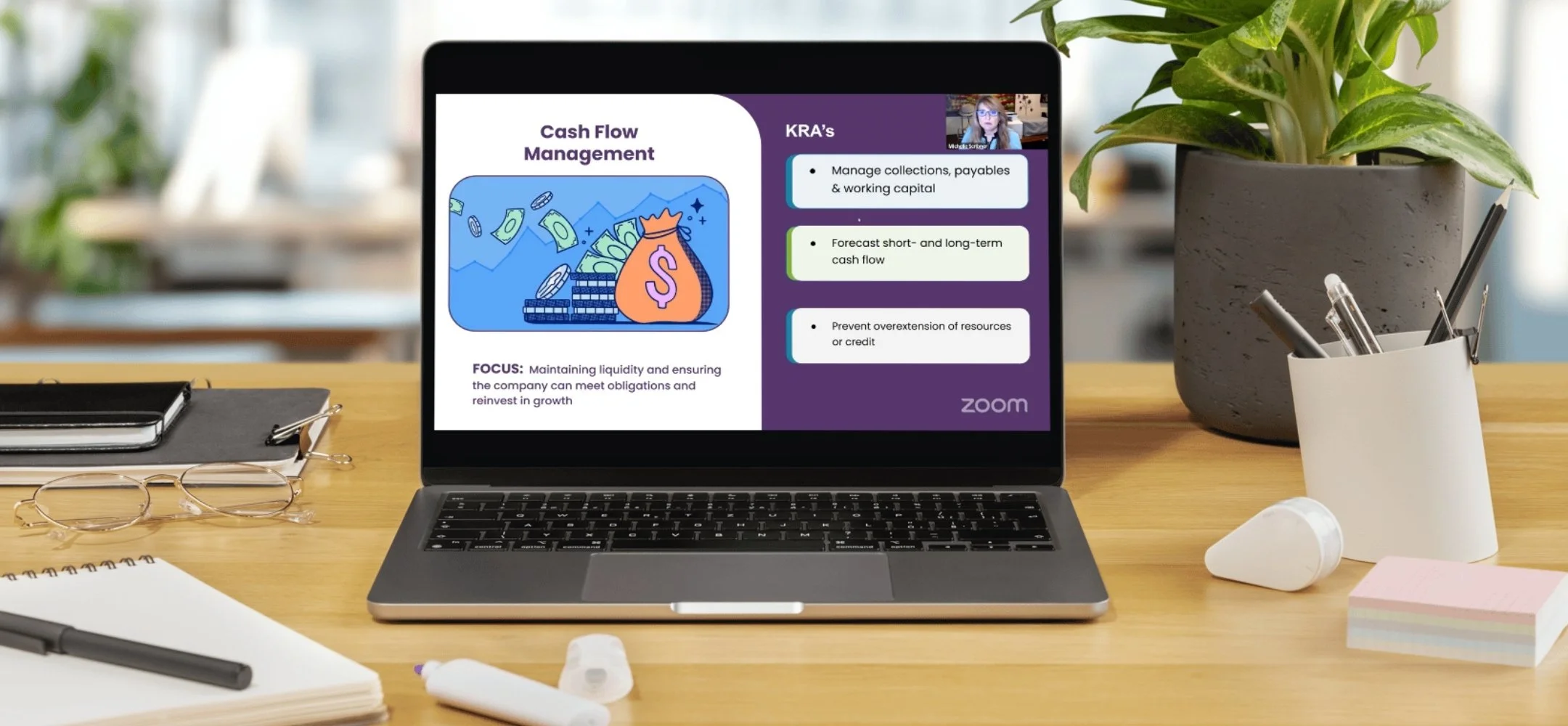

Key Result Areas (KRAs): The broader outcomes those numbers help you achieve.

Think of it this way: your KRA might be "financial stability." The KPIs that inform that outcome include cash flow remaining, debt-to-equity ratio, and months of operating expenses in reserve.

Every business decision should connect back to a result you're trying to achieve—and every metric you track should inform that result.

The five foundational areas every business must measure

Regardless of your industry, business size, or growth stage, five areas form the foundation of business health:

Profitability management – Are you making money after all costs?

Operational efficiency – Are you using resources wisely?

Financial stability – Can you weather challenges?

Cash flow management – Do you have money when you need it?

Growth and customer satisfaction – Are you attracting and keeping the right customers?

What you measure within each area depends on your business stage and current challenges. But these five categories are universal.

The six KPIs that reveal the most

Rather than tracking dozens of metrics, focus on these six core KPIs:

1. Gross Profit Margin

Formula: (Revenue - Cost of Goods Sold) ÷ Revenue

This is your most important number. It shows whether your pricing strategy works and your direct costs are under control—before overhead even enters the picture.

If your gross margin is too low, no amount of operational efficiency will save you.

2. Operating Profit Margin

Formula: Operating Income ÷ Revenue

This adds overhead expenses (but excludes taxes and interest) to show how efficiently your day-to-day operations run. It reveals whether you're managing capacity well or bleeding money on inefficient workflows.

3. Net Profit Margin

Formula: Net Income ÷ Revenue

The complete bottom line including taxes and interest. This shows your business's true financial sustainability and the impact of debt on long-term viability.

4. Cash Flow Remaining

Formula: Cash In - Cash Out (over a specific period)

This is the reality check. Profit on paper doesn't pay bills—cash does. This metric accounts for accounts receivable timing, accounts payable float, debt payments, and asset purchases that don't show up on your P&L.

Formula: Total Marketing & Sales Spend ÷ Number of New Customers

How much does it cost you to bring in a new customer? This number means nothing without context—which is why you need the next metric.

Formula: Average Revenue per Customer × Gross Margin × Average Retention Period

How much revenue does a customer generate over their entire relationship with you? Compare this to acquisition cost. If lifetime value is 3-5x your acquisition cost, you have a sustainable growth model.

Start where the pain is greatest

Here's the most important lesson from the workshop: don't try to track everything at once.

Identify your biggest pain point right now:

Is cash flow keeping you up at night? Focus on KPI #4.

Are margins shrinking? Start with KPI #1.

Wondering if your marketing spend is working? Track KPIs #5 and #6.

Once you solve one problem, the next priority will surface naturally.

How to put this into practice

This week: Choose one KPI that addresses your current pain point. Set up a simple way to track it consistently.

This month: Establish a baseline. Don't worry about perfection—focus on gathering enough data to see patterns.

This quarter: Review what you've learned. Are you tracking the right thing? Has solving one problem revealed a new priority?

Understanding your KPIs isn't about creating busy work or generating reports nobody reads.

It's about developing the financial intelligence to make confident decisions and build a business that grows strategically rather than reactively.

Because the right numbers don't just tell you where you've been—they show you where to go next.

Ready to get clarity on your business metrics?

Take our free Business Health Check Quiz to see how well your current systems are supporting strategic decision-making.

Or download our guide: Is a Fractional CFO Right for Your Business? to explore whether you're ready for strategic financial support.