Can Profit First Work for Your Business? (You bet—Here's How to Customize It)

One system, endless ways to customize it for your business success.

You've heard about Profit First. Maybe you've read the book, listened to a podcast, or talked with another business owner who swears by it. But you're wondering: "Will this actually work for my business?"

As a Master Certified Profit First Professional firm serving over 200 businesses monthly, we can confidently tell you: Yes, Profit First can work for your business—whether you're in real estate, construction, creative services, or any other industry.

But here's what most people miss: the system needs to be customized to fit your specific business model. Let's break down how.

Why Standard Financial Systems Don't Work for Every Business

Before diving into customization, let's address why generic financial approaches often fall short:

Most financial systems were designed for manufacturing or retail businesses with predictable cash flow cycles. But your business might have:

Seasonal revenue fluctuations

Project-based billing cycles

High materials costs that vary by job

Industry-specific cash flow challenges

When you try to force a standard system onto your unique business, you end up frustrated and ready to abandon it altogether. We've seen this happen repeatedly with business owners who tried Profit First on their own.

The Core of Profit First Remains the Same

While customization is crucial, these foundational elements work for every business:

The reversed formula: Revenue - Profit = Expenses (not the other way around)

Separate bank accounts for different purposes

Regular allocations of incoming revenue

Intentional spending based on what's available in your Operating Expenses account

These principles create clarity and behavioral change regardless of your industry. The magic happens when we adjust the implementation details to match your business model.

How to Customize Profit First for Your Industry

For Real Estate Professionals

Whether you're in sales, property management, or development, real estate businesses face unique challenges:

Commission-based income: Create a "Revenue Holding" account to smooth out irregular income

High marketing expenses: Establish a dedicated "Marketing" account with a set percentage

Team structure considerations: Separate "Team Commissions" from your operating expenses

Seasonal fluctuations: Build a "Revenue Reserve" with higher allocations during peak seasons

With a tailored Profit First setup, real estate businesses often experience more consistent income, smoother profit distributions, and clearer visibility into financial performance.

For Construction & Trades

Construction businesses have material-heavy expenses and project-based revenue:

Materials & Subcontractors (M&S) account: Allocate job-specific expenses separate from operating expenses

Project pre-funding: Move funds to M&S before project begins

Specialized tax planning: Account for higher equipment depreciation and job-specific deductions

Progress payment management: Create a "Progress Payment" hold account to ensure funds are available through project completion

Construction businesses implementing these customizations typically see improved job profitability, reduced cash crunches between payment milestones, and clearer financial decision-making for equipment investments and hiring.

For Creative Service Providers

Agencies, consultants, and creative professionals have their own challenges:

Retainer management: Create a "Retainer Reserve" account to smooth service delivery costs

Project vs. ongoing work balance: Separate allocation percentages for different revenue streams

Lower overhead, higher pay considerations: Adjust owner's pay percentages for businesses with minimal staff

Intellectual property investments: Create an "IP Development" account for non-client creative work

Common Customization Questions

"How many bank accounts do I really need?"

The traditional Profit First method recommends 5-7 accounts. However:

Micro-businesses (under $250K revenue) can start with just 4 accounts

Real estate and construction often benefit from 7-9 accounts

Service businesses typically need 5-6 accounts

Remember: each account serves a specific purpose. Too few creates confusion; too many creates unnecessary complexity.

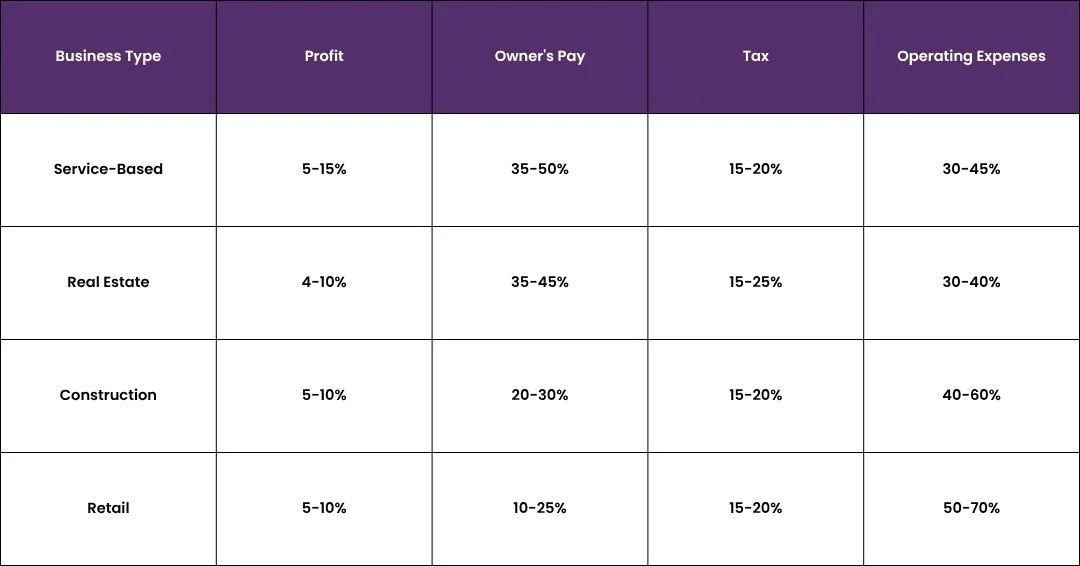

"What allocation percentages should I use?"

While the book provides general targets, industry-specific targets make more sense:

Note: These are starting guidelines. Your ideal percentages depend on your specific situation.

"What about debt repayment?"

Debt shouldn't prevent you from implementing Profit First. In fact, it's a reason to start sooner:

Create a dedicated "Debt" account

Allocate 1-5% of revenue toward debt reduction

Make consistent payments while maintaining other allocations

Increase debt percentage as profitability improves

This approach balances immediate financial health with long-term debt elimination.

Real-World Customization Example

Here's how we helped a construction company implement Profit First:

Before:

Revenue: $1.2M annually

"Profit" on paper: 12%

Actual take-home profit: 2%

Constant cash flow stress

No clear financial direction

Our Customized Approach:

Created specialized accounts for Materials & Subcontractors and Equipment Purchases

Implemented pre-funding requirements for all new projects

Established realistic allocation percentages based on industry benchmarks

Set up a quarterly financial review rhythm

After 12 Months:

Revenue: $1.4M annually

Paper profit: 15%

Actual take-home profit: 8%

Owner's compensation: Increased by 30%

Stress level: Dramatically reduced

Clear path for continued growth

The difference wasn't just financial—it was behavioral. The owner made better decisions because the financial structure supported smarter choices.

Why Behavior Matters More Than Numbers

Here's what makes our approach at Sum of All Numbers different: we focus on behavior change, not just numerical targets.

The most perfectly designed financial system will fail if it doesn't change how you interact with your money. Our clients succeed because we:

Start with manageable changes rather than overnight transformation

Address emotional patterns around business finances

Build accountability systems that support long-term habits

Provide a team approach so you're never trying to figure it out alone

Financial success isn't about having the perfect spreadsheet—it's about making consistently better decisions over time.

Ready to Customize Profit First for Your Business?

The first step is understanding exactly where you're starting from. Download our free guide: "Profit First Quick-Start: Industry-Specific Implementation Templates" to see how strategic finance applies specifically to your business model.

This guide includes:

Industry-specific account structures

Recommended allocation percentages

Implementation timelines

Common pitfalls to avoid

Is your business facing unique challenges that need personalized guidance? Schedule a free discovery call to explore how we can help create lasting financial clarity for your specific situation.